The $50k Challenge Update 22 – 21/09/2021 Stock Code: ZEO Shares Sold: 167,000 Share Price: 0.09 Total Profit: 1,400% / $14,000 Shares remaining: 665,000 Reason for Selling From a fundamental’s perspective, ZEO has been a fantastic performer as management continue to delivery/execute on the companies’ objectives. I am very much still bullish on ZEO, however I need to clear funds …

The $50k Challenge – Update 21

The $50k Challenge Update 21 – 09/07/2021 Stock Code: BMM Shares Purchased: 190,000 Share Price: $0.20 SOI: 45,000,000 Cash: $6,500,000 Listing price: $0.20 Market Cap: $9,000,000 EV: $2,500,000 Reason for buying: Director ownership: One director is subscribing for $200,000 in shares in the IPO. Other directors only own options. BMM however is a spin out from JDR who owns 22% …

The $50k Challenge – Update 20

The $50k Challenge Update 20 – 28/05/2021 Stock Code: LCD Shares Purchased: 476,000 Share Price: $0.08 Total Profit: $28,250 Reason for selling: LCD has been a good performer over the past few months through their acquisition Murchison Gold project. I have decided to sell LCD solely due to the fact that I needed to clear up funds for an upcoming …

The $50k Challenge – Update 19

The $50k Challenge Update 19 – 14/01/2021 Stock Code: PF1 Shares Purchased: 34,482 Share Price: $0.29 Total Shares: 196,645 Reason for Purchasing more: Since my original purchase on 24/11 one of the directors has purchased shares on market on 3 separate occasions which is fantastic. Since listing he has now purchased over $300k worth of additional shares on market. Iron …

The $50k Challenge – Update 18

The $50k Challenge Update 18 – 24/11/2020 Stock Code: EMD Shares Purchased: 352,941 Share Price: 0.087 Reason for buying Low market cap of $18m with $2m in cash Board of Directors own 32% of the register Top 20 own 59% of the register No debt Cannabis sector just starting early phase bull market due to recent legislative changes. EMD undervalued …

The $50k Challenge – Update 17

The $50k Challenge Update 17 – 23/12/2020 Stock Code: 8CO Shares Sold: 255,000 Share Price: 0.12 Total Profit: 85% / $14,025 Reason for Selling Ultimately I sold 8CO for two main reasons. Firstly their revenue growth stalled and the expected uptick when COVID restrictions were lifted did not occur. Secondly the entire payments sector has died out with the majority …

The $50k Challenge – Update 16

The $50k Challenge Update 16 – 24/11/2020 Stock Code: PF1 Shares Purchased: 162,163 Share Price: 0.185 Reasons for buying Incredibly low EV of only $4.7m $6m cash so no credit raisings required in the foreseeable future Management team continue to purchase shares on Market Major shareholders also increasing their stake since listing by purchasing shares on Market PF1 owns a …

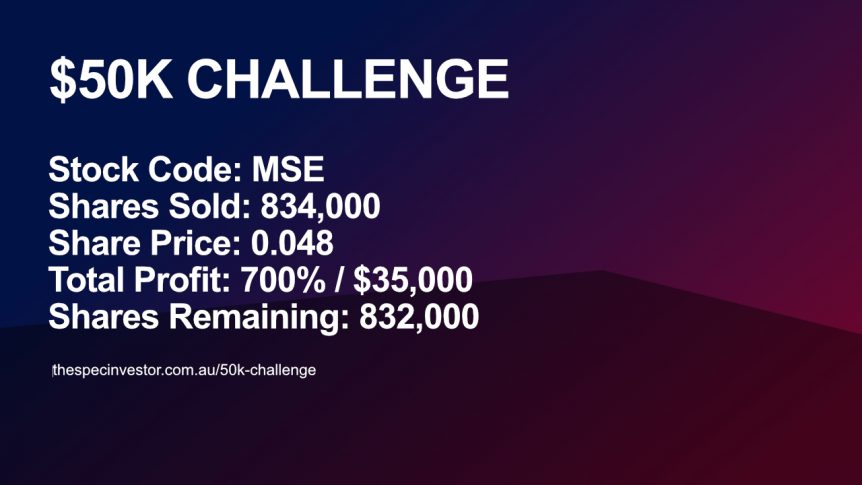

The $50k Challenge – Update 15

The $50k Challenge Update 15 – 23/11/2020 Stock Code: MSE Shares Sold: 834,000 Share Price: 0.048 Total Profit: 700% / $35,000 Shares Remaining: 832,000 Reason for selling: This will be the shortest “reason for selling” to date. The only reason I sold MSE was because it ran so hard that it occupied nearly half of my total portfolio. My Strategy …

$50K Challenge MSE Review

As stated in my $50k Challenge Annual Review post I will be providing an update on the stocks that are in my portfolio as quite a bit has happened since I purchased them. Every week I will release an update on 1 stock with this week focussing on MSE. Company Name: MSE Purchase Price: 0.006 Current Price: 0.013 Corporate Update: …

The $50k Challenge – Update 14

The $50k Challenge Update 14 – 14/07/2020 Stock Code: 8CO Shares Purchased: 255,000 Share Price: 0.065 Reasons for Buying: Management own 25% of the register No Debt $1.8m Cash in the bank Major clients including various Australian Government departments Financial Analysis: FY20 revenue up 8%. This would have been much higher if not for COVID impacts SaaS revenue up 30% …