An introduction to The Great Martis

I first stumbled on the Great Martis on a stock market forum called Hot Copper. He was this larger than life figure making what looked like incredibly ridiculous calls. I was still early in my investing career and I came across a stock that was trading at less than 1c. The Great Martis boldly and confidently proclaimed that the stock was going to be a huge multi bagger.

I broke my cardinal rule of buying a stock based on a social media tip and jumped head first into this stock I knew very little about. It immediately started running hard and before I knew it we were at 3c. It didn’t stop there though and after a couple of announcements it had ran to over 7c.

Unsurprisingly it was a very short lived run and I gave back most of my

gains by holding for too long.

That’s beside the point though, his larger than life personality made

him the most followed person on Hot Copper which holds a 90%+ market share in

the Aussie stock market forum sector. I’ll let Martis explain in his own words

how it ended for him though on this forum where he was very much the most loved

and hated person.

“The Great Martis was suspended on hot copper because he was apparently too powerful and could move markets WEEKS later. The Great Martis registered himself on Top Stocks the competitor to Hot Copper and it took only 2 weeks before The Great Martis became the most popular poster only to be pulled up by the owner accused of running a pump and dump scheme. A threatening email was received and was threatened with possible legal action the end result was that it come to light that The Great Martis was a lone wolf that was gifted in predicting outcomes with dead accuracy UNMATCHED UNRIVALLED GOD BLESS.”

Tell us a bit about you and what got you into markets in the first place?

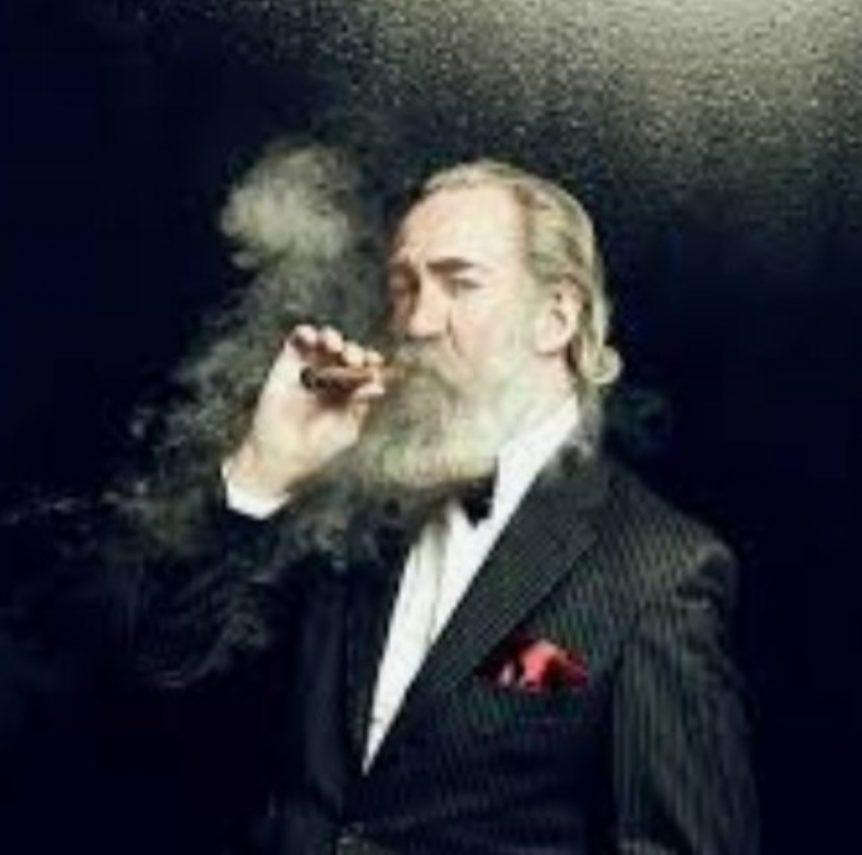

The legend of The Great Martis roots are unknown. Some say he was consummated in a brothel others say he was born on the summit of Everest. Forums whisper his name dinner, parties entertain his epic godlike trades and the financiers question his mortality.

Million dollar deals he rejects while offers that no man can refuse he cringes at. Has been known to place short bets bigger than the entire GDP of Botswana and yet he is known as a humble man and a philanthropist.

When I was a young boy many moons ago I was having lunch with a friend of mine who was a trader. At the time I had no work and he was always keen to teach me the art of speculation and I was always fascinated with numbers. We traded together for a few years until he retired. Then the legend was born.

Can you give us a summary of your trading strategy?

My trading strategy consists of following the flavour of the month. I would look at the most bullish index and research companies that follow it. I use fundamentals and technical analysis to determine which stocks have a high probability of moving. I look for certain formation .i.e ascending triangles, inverted head and shoulders and rectangles. I also use the TAPE before buying IF the sellers outweigh the buyers I would wait.

I also prefer stocks that have touched resistance a few times whilst making a higher low every time with Descending volume. Once volumes arrive just under resistance I buy. If my buy does not become the bid almost immediately, I usually sell it (signifies wrong timing). I then will wait and see how the stock acts if it has another go at resistance, I will have another go if my buy becomes the bid immediately, I then sit and wait if it breaks and moves higher, I then add to my position.

I don’t use stop losses. When I purchase it must act immediately otherwise, I sell out. Sometimes it takes a few goes to get it right. When selling I look at upper end resistance levels (using charts). I always know when I am going to sell even before I get in. I always have a plan before buying or shorting. I will cut the trade short very quickly if it doesn’t act right.

If there was one thing you know now that you wish you knew when you first started what would it be?

If there was one thing I wish I knew back when I first started trading it would be risk management. NOTHING is more important than Risk management. Most of my time these days is devoted to risk management. My trading account today consists of one total sum. I never add to it if I make a profit it leaves my trading account if I get under that total, I tighten my trading until I recover.

The key to longevity in the stock market is 80% risk management, meaning if you don’t treat the markets as a business EPIC failure is a certainty. So what I have learnt over the decades is to separate the plan from monetized thinking whilst in a trade.

Meaning if I am in a trade, I don’t calculate my winnings if the stock keeps on rising, all I care about is executing my plan and strategy. This keeps away temptation of selling too early. So, the foundation of my risk management is to separate the two “emotional money ” VS ” A plan”. Keep those two apart whilst conducting business and success will outweigh failure 95% of the time.

Tell us about your biggest winner?

My Biggest win was in late 07 when I shorted banks across the board and held until late 08.

Took a position in ANZ CBA NAB WBC. I placed a $1 million dollar bet on each and every bank leveraged. Made $12 million late 08 when I covered.

Tell us about your biggest loser and how did you mentally recover from that?

Biggest loss was the Poseidon bubble in 1970. I lost $1 million in 2 days. $1 million back in the 70s was like losing $10 million today.

I took 6 months off to regroup but I never lost my nerve I studied even harder. I Got a loan and started all over again. When I got nailed in the 70s and lost it all I never lost hope. I did feel depressed but I always knew I had the knowledge to come back. That helped me a great deal in my recovery but I also knew if I did get up again I would have to change my thinking and that’s when I started to hit the books harder and longer.

I probably studied the markets 100 hour weeks to come up with a plan and risk strategy to avoid losing it all ever again. So from thinking as a gambler I transformed my thinking to treating the markets as a risky business.

The hardest part was to accept what I had and what I was left with but I never lost hope. I always looked at the bigger picture and always knew that I had the ability to come back if only I changed my thinking, which I did.

What’s the usual warning signals that a spec stock has gone bad and it’s time to leave?

Usual warning signals of a stock going bad is when it either goes against you or goes parabolic Heavy volume most always signals the END of a move.

Three candlesticks that a very reliable knowing when your stock will turn include The dark cloud, engulfing red candle and a shooting star. If these candles are depicted on a chart it’s a warning. If trading without charts then I would look at volumes ..if u get heavy volume the day after a large move and the stock doesn’t move it most always signals a reversal. And always keep a tight stop no more than 2%.

You’ve been known for your extreme bearishness. Can you summarise your view on the future of the stock market?

Negative yields…Unprecedented global Govt repo intervention ..Negative Global Growth ….Mass logistic disruptions across globe …Mass trade disruptions across Globe …Skyrocketing global unemployment.. Unprecedented Reckless Government Market intervention across all Instruments …S&P500 MC VS GDP is at historical highs whilst EPS is deteriorating. The above mentioned is what the globe is dealing with at the moment…

The inevitable outcome in my opinion is an inevitable reset of the whole financial system. I do believe that we are only in the rudiments of a mass deleveraging event that will make 08 look like a bull market. Below is a chart depicted showing a Broadening formation. A broadening formation at historical highs is a very bearish formation with devastating consequences. The Broadening formation suggests a DOW target of 7k.

To add I do believe GOLD and SILVER will hit unprecedented highs in the coming years.

I would like to thank The Great Martis for his willingness to share his time and experiences as a guest on The Spec Investor. We both hope you enjoyed this Q&A!

If you’re looking to take your Penny Stock Investing to the next level feel free pop in and learn more about my newly released investing course.

To ensure you are notified of all future articles and Q&A sessions please subscribe by entering your email address below.